CUT OUT THE BROKERS

WORK WITH A DIRECT BANK

We provide no-cap funding at competitively low interest rates for business owners who have been in business for at least 1 year and have a 680 credit score or better.

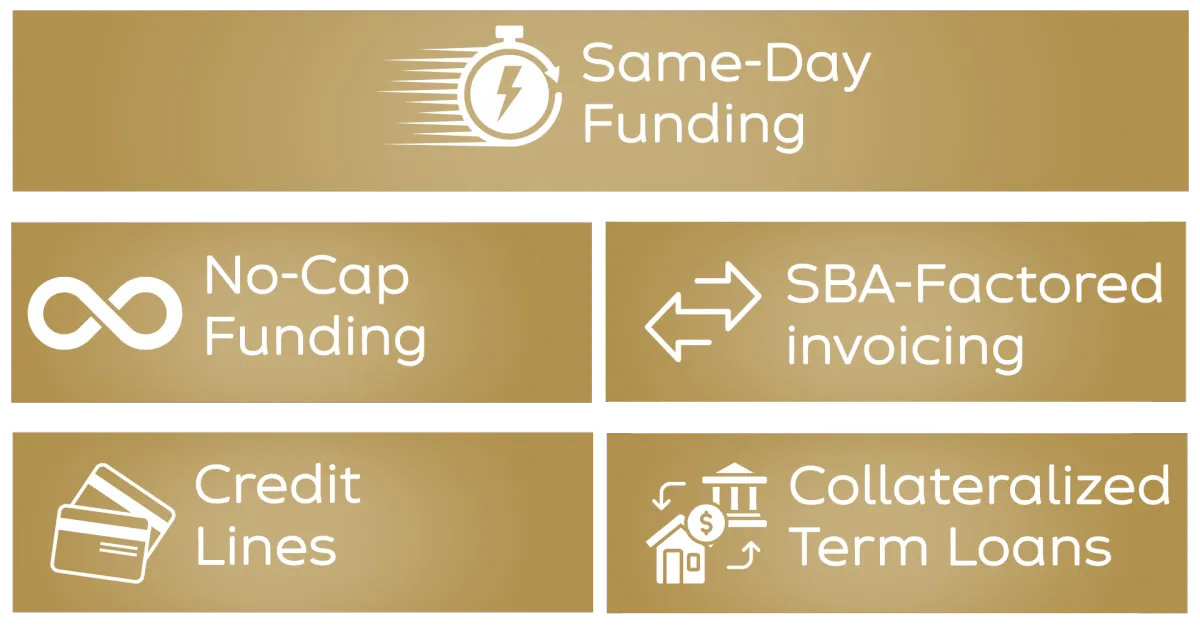

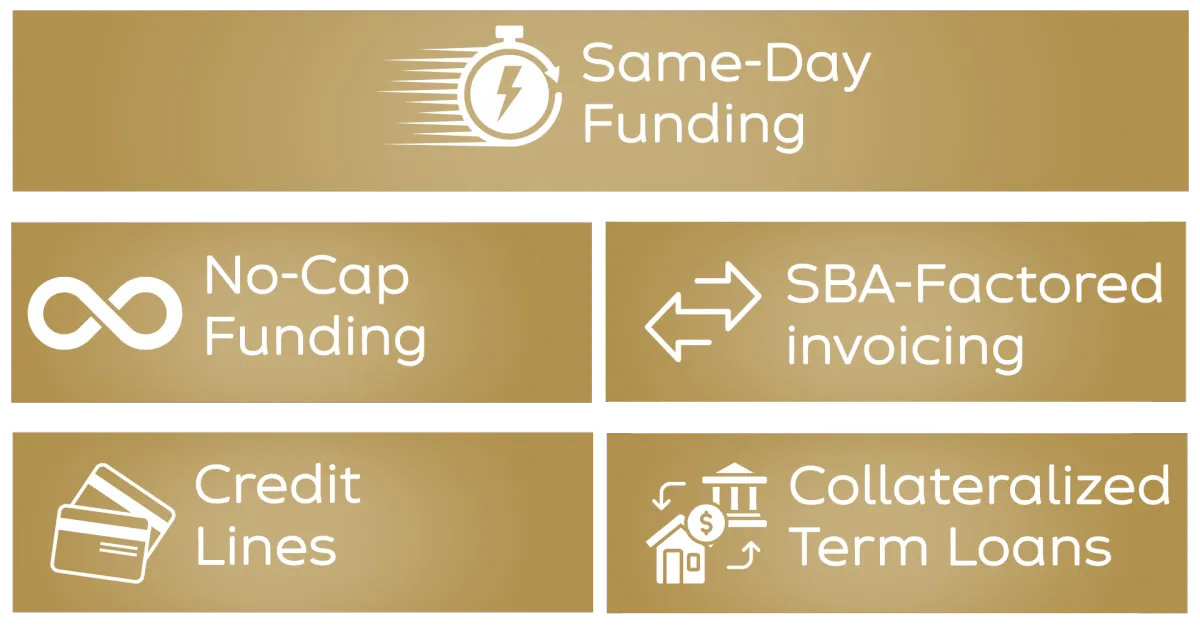

If you meet these requirements, you could be eligible for a wide range of business funding options best suited for your needs:

Note: Funding terms, approval amounts, and interest rates vary based on your credit profile, business structure, and timing of application. All funding estimates are based on current lender data and may be adjusted as new offers or documentation become available. Final terms are confirmed after full review and lender approval.

Businesses Grow Beyond Their Limits with the Right Capital.

We Aim for Excellence across Every Metric.

Freyja FINANCIAL

$300M+

FUNDED & COUNTING

We’ve secured capital for businesses looking to fund operations or simply grow and expand

CLIENTS FUNDED

1,000+

ACROSS THE U.S.

From fast-growing start-ups to multi-location businesses.

FUNDING PROGRAMS

20+

OPTIONS AVAILABLE

We match you with the best-fit option — no guesswork required.

Recent Client Wins

Cattle Industry

$372K Funded

Same-Day Funding

Department of Defense Contractor

$3.2 Million Funded

Same-Day Funding

Restaurant

$1.2 Million Funded

Same-Day Funding

Roofing Company

$485K Funded

Collateralized Term Loan

Restaurant

$479K Funded

Collateralized Term Loan

Restaurant

$150K Funded

Credit Lines

Wholesales

$500K Funded

Credit Lines

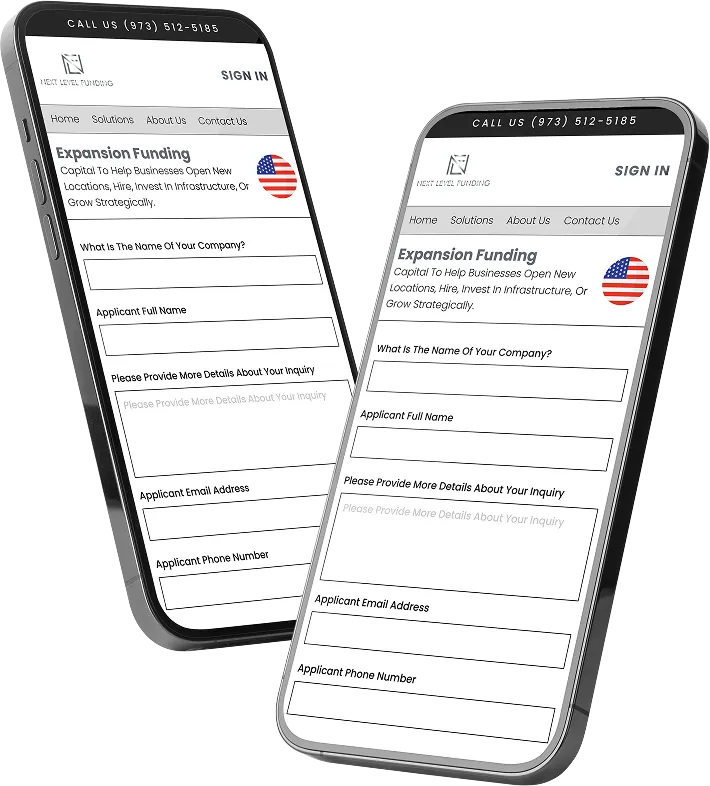

Business Funding Made Simple

No confusing terms. No slow approvals. Just Flexible funding options at sustainable interest rates so you can expand.

Freyja Financial Approach

It’s Simple...

We provide substantial low-interest funding to companies seeking capital for growth, operations, or expansion.

We base our approvals on your personal credit history and business tenure, not revenue or tax returns.

Typical clients receive 6 to 8-figures in capital.

No upfront fees — we only win when you do

Complete the form, and our team will call you. Within two minutes of that call, we’ll begin moving your funding process forward.

Explore our funding solutions:

The Smartest C-Suite Execs Don't Wait for Banks...

They Secure A Real Banking Relationship With Us — Then Take Market Share.

You Are Resourceful and Move Fast.

We Help You Get Funded Without Complex Paperwork

When most people hear "funding" they think long waits, hidden fees, and bank rejections. We built a process that’s different. With 20+ tailored programs and a team that works fast, we help business owners access capital without the stress, delays, or guesswork.

Our Quick & Easy Process To Get You Funded

READY TO TALK TO OUR TEAM?

FREYjA FINANCIAL 2025 © | Disclaimer | Privacy Policy

Frequently Asked Questions

We’ve answered the most common ones so you can move forward with confidence.

How much funding can I qualify for?

Unlike most lenders, we are a Direct Bank, which means we offer No-Cap funding. Your personal credit profile, business tenure, and other supporting elements will determine the level of capital you can access through us.

Do you offer funding for new businesses?

It really depends. We require at least 1 year in business to apply. If your business tenure meets this requirement, we encourage you to speak with our team.

How fast can I get funded?

Although we aren't about fast funding and instead focus on substantial low-interest funding, many clients receive approval within 24 hours and funds as soon as the next business day.

Will this affect my personal credit?

No hard credit pulls to apply. We will, however, do a deeper dive into your credit history once you've agreed to work with us.

What credit score do I need to apply?

A 680+ FICO is required, but we look at your business holistically—including time in business and other supporting elements you are willing to provide to better your odds of approval.